![]()

This article is part of a larger series on How to Do Payroll.

Get Your Free Payroll Ebook With Downloadable Templates

Send to me![]()

Direct deposit is a secure electronic method of transferring funds from one bank account to another. In terms of payroll processing, employees receive their wages directly in their designated bank account instead of receiving a physical paycheck. This method of payment offers several advantages, including convenience, speed, and security.

The steps for setting up direct deposits are as follows:

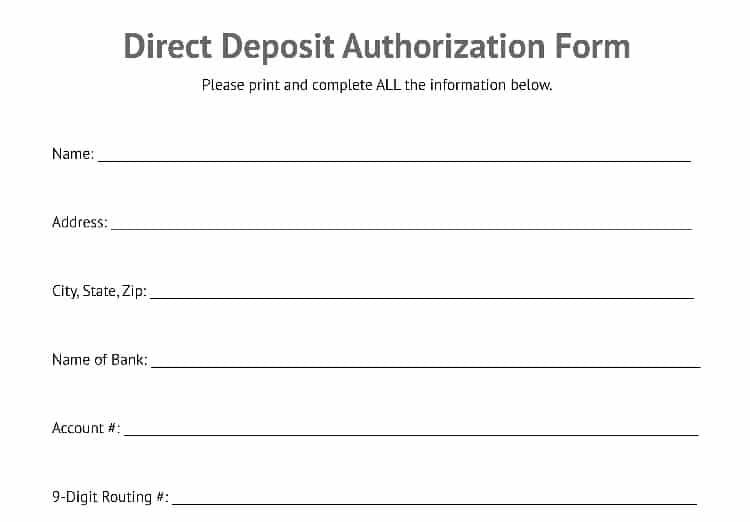

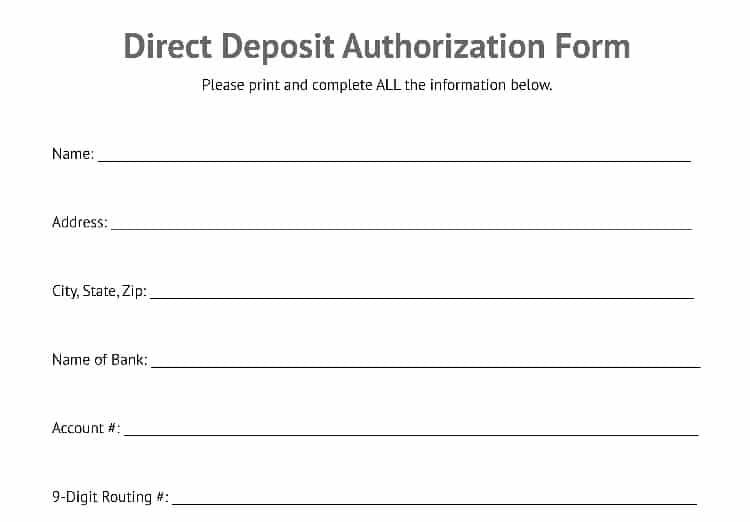

Setting up direct deposit can be done through your bank or through a payroll provider. In either case, you’ll need to get signed authorization from your employees before pushing through with direct deposit payments. You can use our free direct deposit authorization form template for an easier time with this.

FILE TO DOWNLOAD OR INTEGRATE

Direct Deposit Authorization Form Template

Download as Word Doc Download as Google Doc Download as PDF

The two most common ways to set up direct deposit are through your bank and with your payroll software. Many payroll software offer this function and can automatically process payroll as direct deposits. There are also some HR services and software with payroll capabilities that can provide direct deposit services. If you are paying for payroll services, it makes sense to let them handle the direct deposit work.

For payroll software that can handle your direct deposit payments for you, we recommend Gusto. Employees can fill out their account and routing number, sign a direct deposit authorization during onboarding, and be ready to receive direct deposits right away. Learn more about it in our Gusto review.

No matter which option you choose, your bank is the one that transfers the funds. Thus, if you don’t work with your bank directly, you will need to share your bank account information with the software or service provider to have direct deposits set up. If you’re looking to open a new account, check out our comparison of the best options:

Best Banks for Small Business Basic Checking Account Monthly Fee Free Monthly Transactions Free Cash Deposit Limit Learn More Silver Business Checking $2,500 per month Business Complete Banking $15; waivable $5,000 per month Business Checking 2.0% on qualifying balances of $250,000 or less $4.95 per deposit (Green Dot) Fundamentals Business Checking $16; waivable $7,500 per month Relay Standard No fee; Accepted at Allpoint ATMs Business Checking No fee; cash deposited through money orders Basic Business Checking $15; waivable $5,000 per month Innovator Business Checking Cash deposits not accepted Business Checking Cash deposits not accepted Business Checking Accepted at certain retail locations for a feeLearn more about these banks and what they can offer in our roundup of the best small business checking accounts.

Banks usually charge a setup fee of up to $150. Some will charge monthly or transaction fees, which typically can run from $1.50 to $1.90 per individual transaction.

Once you’ve decided on your direct deposit service, it should tell you the steps you need to take to set up your direct deposit. Remember that it can take a few days to a week to have everything in place. It’s important to set realistic expectations with your team so your employees don’t expect direct deposit with their next paycheck if it’s not yet possible. Click the tabs below to learn the specifics of setting up direct deposits through your bank or with a payroll service provider:

To arrange a direct deposit with your bank, you can call and talk to a representative to lead you through the process or use your online portal to do it electronically. Each bank is different, so reaching out to your local branch to find out the process is a good place to start.

You’ll sign the automated clearing house (ACH) terms of agreement, and may need to either manually upload a NACHA file to your bank’s website or send it via another electronic method. A NACHA file is a specially formatted file that provides payment instructions on how to distribute money via a large batch of payments, i.e., to your employees.

You might also have to provide financial statements to prove you currently have and are likely to continue to have the cash available to finance the regular payrolls. At this time, you will also want to discuss how often you plan to run payroll.

If you need a bank, consider Chase Bank. It’s our No. 1 recommended bank for small businesses. It has a $300 introductory bonus, waives fees on some checking accounts, and provides services via physical locations and online. Sign up to try it out today.

If you are using a payroll service, it will set up the direct deposit for you. You need to provide your bank account information (routing number and account number).

There may be a verification process for you to go through that could include a test withdrawal. This means that a small amount (usually under $1) will be deposited into your account and then withdrawn (or vice versa) to make sure the service can access your funds.

Although direct deposit is the most common way to pay your employees, your workers still must choose to be paid via direct deposit. Many states have their own regulations about how employees can be paid and whether or not you can mandate electronic payments for your team.

For more detailed information on your state’s mandates around direct deposits, check out our state payroll directory for easy access to all of our state payroll guides.

You will need signed consent to access your employee’s bank account information. We recommend you download our direct deposit authorization form template that you can distribute to all employees to help collect their information more easily.

FILE TO DOWNLOAD OR INTEGRATE

Direct Deposit Authorization Form Template

Download as Word Doc Download as Google Doc Download as PDF

Pro Tip: If you have an HR or payroll software with an employee portal, you can have your employees fill out the information through the portal. However, make sure that as the employer, you have full access to this information, as some services will mask sensitive information, such as bank account numbers and Social Security numbers (ex. **** *** **038).

When having your direct deposits set up, it’s important to determine a regular pay period that works best for your company and employees to make sure that your payroll process runs smoothly. To help make that decision, consider the following:

Your first pay run can take longer than usual, so allow extra time for setup to complete. It’s a good idea to run a test pay run of only a penny or other token amount. Ask employees to be on the lookout for this and to let you know if they have not received it by a specific date so you can track down any errors.

Benefits of Direct DepositsDirect deposits offer several benefits for both individuals and businesses. Here are some of the key advantages:

One of the prime benefits of direct deposit is that it is generally timely and error-free, as long as you enter the correct payroll information. However, errors can occur. Here are some of the most common (though rare) problems that people experience with direct deposit and how to handle them.

Wrong Employee Account NumberPrevention is the best way to stop these errors. First, ask for a copy of a canceled check, so you can verify the account and bank routing numbers manually. Next, do a single test deposit of a penny to ensure the payment goes through correctly. Banks often catch errors and will either put the money into the correct account (sometimes with a delay) or refund it back to you.

If, despite all this, the employee claims they are not getting their paycheck, start by verifying you are sending to the account they’re checking (for example, if the employee gave you their savings account information instead of checking).

If somehow, the money does go to a legitimate but wrong account, you have five days to request a reversal. The payee must be notified, as outlined in the form instructions—but this is only a heads-up vs request for permission to transfer. You may first need to put a trace on the money to find where it has gone. In the meantime, you can cut your employee a paper check, put in an out-of-cycle payment to cover the paycheck, or have the employee work with their bank to credit them the money pending the actual deposit.

Payroll Didn’t Deposit on TimeIf you completed payroll on time, but your employees are saying they did not get their paychecks, you should first check that you actually did meet the correct deadline and allowed enough time for processing. Direct deposit can take two to four days to process—longer, if payday falls on a weekend or holiday.

If you have your dates correct, check that your account has sufficient funds to cover payroll. If that is not the problem, then call your bank or payroll service.

Wrong Paycheck Amount DepositedIf your employee receives the wrong paycheck amount, check your payroll records. Were hours correctly calculated? Were all withholdings accounted for? Are the decimals in the right place?

Also, check that the employee did not ask for a split payment and if part of the balance was deposited to another account or is going to someone else for child support or other withholdings. You can correct errors by processing an additional transfer or check payment.

If you overpaid, you may be able to dock future paychecks, but be careful. Some state laws have strict rules about how you can retrieve overpayments (for instance, California); you still have to ensure the employee is receiving minimum wage.

Deposits Are Delayed Due to HolidaysSome banks don’t record deposits on holidays. Your best bet is to be prepared and run payroll early. The best employers plan so that deposits are made on Fridays if a payday falls on a weekend or bank holiday. That way, employees have their paychecks for the weekend.

Direct Deposit Payment Made TwiceThis is usually due to human error in the payroll. Be sure to check that an employee is not listed twice and their payroll information is correct. You have five days for recalling the erroneous paycheck by putting in a Request for Reversal order. The reversal must be for the full amount, and the employee must be notified about the transaction.

National Automated Clearing House Association (NACHA) rules stipulate the entire amount must be refunded at once. Thus, if an employee’s account does not have enough funds to bankroll the reversal, then you will need to work with them on some other way to pay back the error.

Yes. The most common way to get a direct deposit without a bank account is by using a prepaid debit card. You can buy it at most major retailers. When you set up direct deposit, you will provide your employer with the card’s account number and routing number. Your paycheck will be deposited onto the card, and you can then use it to make purchases, withdraw cash, or transfer money to another account.

On average, a direct deposit takes two to four business days to clear. However, there are a few factors that can affect the processing time, such as the type of payment made, the time and day of the payment, and bank policies.

Companies use a variety of methods for direct deposits, including banks, payroll providers, ACH networks, and mobile banking apps. The best method for a company to use for direct deposits will depend on a number of factors, such as the size of the company, the number of employees, and the company’s budget.

Setting up your payroll with direct deposits for your employees can save your business some time and money. By sending paychecks directly to your employees’ accounts, you don’t have to deal with paper checks, and employees have access to their money right away. Although the process is generally seamless, errors are possible—so ensuring that the setup is done properly is crucial.

If you’d prefer to use payroll software that will set up and facilitate direct deposit for a small business, check out Gusto. Employees can authorize direct deposit payments during their onboarding process and Gusto will handle the rest. Try it today and get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

Find Genevieve On LinkedIn

Genevieve has more than 13 years of writing experience, working with different clients in various industries. Genevieve also worked as an HR Head of a local manufacturing company, and has helped small businesses set up their business and HR processes.